For years, observers have turned to the ECB to provide them a comparison-basis to judge the FED and its policies. As Europe is likely to undergo an extended period of under-par growth and internal questioning and as China gains momentum on the international scene, attention will turn to the Chinese central banking model and how it fares relatively to its Northern American counterpart.

Comparing China and America is a perilous exercise given the stark differences between both countries. A country of 1.3 billion inhabitants which has undergone in the past 30 years the fastest-paced political and economic streamlining in history cannot fall under the broad definition of being a "capitalist" or "communist" country.

Moral hazard, defined as governmental intervention to bail out insolvent parties, is often referred to when describing the USA. Not China. There is no Xiaochuan put. What the US spent to save AIG, the Chinese government used to build infrastructures.

In the 1980's, benefiting from the opening up of the local market, western banks started settling in China and making a series of bad loans to local entities. They took for granted the Chinese government would step in and prevent national companies from failing. It didn't.

As embodied by chairman Bernanke's reelection, trying and failing is accepted, if not rewarded, in the US. In China, accountability of governmental institutions is the first pillar of social rest. In China, the Party cannot fail. It has to "cross the river by feeling the stones(1)".

How monetary policy is considered, channeled and judged is highly impacted by these divergent mantras.

How monetary policy is considered, channeled and judged is highly impacted by these divergent mantras.

- Correlated Quantitative Easing, Mixed Results

Bernanke had announced(2) he would fight deflation at all costs, referring to Milton Friedman's "helicopter drop" of money. The least is to say he held tight to his principles, adding $813 billion to the FED's balance sheet in the 5 months to August 2008.

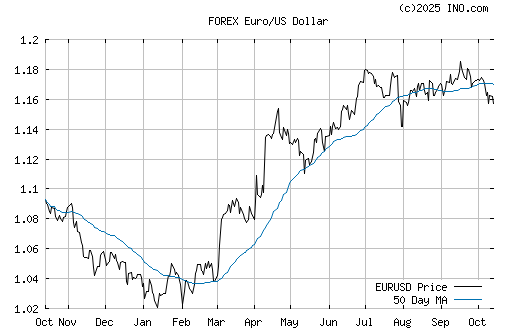

With hindsight, it seems that decoupling presented to heavy an opportunity cost for China and its government. Lacking internal demand and economic knowhow, China had to make do with the US, and reciprocally. Even today, it is hard to say where the USD would stand if the renminbi peg had not be resumed in mid 2008, triggering in the process a rally in the greenback.

Whether it was targeted at sustaining national economic growth, limiting the downside risk on its trade account, or maintaining the renminbi/USD peg, China correlated its monetary stance to its western counterpart's. Monetary mass expanded y-o-y by 32% in China, leaving the country awash with liquidity.

Chimerica had committed to quantitative easing.

Confidence is the backbone of monetary policy efficiency. Without confidence, monetary expansion boils down to pushing on a string.

On the one hand, the FED's credibility had been eroded in the wake of the IT bubble with the so called Greenspan Put. On the other hand, People's Bank of China is ran by the Chinese government which, contrarily to the prevalent opinion among China bears, is supported by its people.

In the US, banks witnessed how market speculation had triggered a run on Bear Stearns, and fear grew they were exposed to similar margin call risks. In China, People's Bank of China has a significant stake in local banks and is hence capable of influencing their policy.

This diverse drivers resulted in similar quantitative easing policies being channeled in deeply divergent ways, and thus entailing different outcomes.

As a result, M2 increased by $538 billion when the FED's balance sheet had expanded by $813 billion, a 40% difference. Bernanke succeeded in what he thought central bankers had did wrong during the Great Depression of 1931: printing sufficient money to maintain M2 expansion. History has taught central bankers a major lesson : when confidence plunges, base money supply is a poor indicator of money in circulation and thus of market liquidity.

The banks' reluctance to lend prevented the FED's expansionary monetary policy from kick starting the real economy. However, the excess money was channeled by institutional investors to financial markets and ignited an asset reflation-led recovery.

China offers a brighter picture of monetary policy effectiveness, local banks having lent accordingly to the PBOC's centrally planned and directive policies.

- Where did the money go?

As a major share of their assets were valued according to mark-to-market standards, fading confidence resulted in a rapid downsizing of American banks' balance sheets. Relying on risk models based on the erroneous assumption of normally distributed returns, banks were caught off-guard. Being granted almost overnight a "free lunch" by the FED's easy money, they used the freshly printed dollars to increase their reserves and thus hedge their margin call risk exposure.

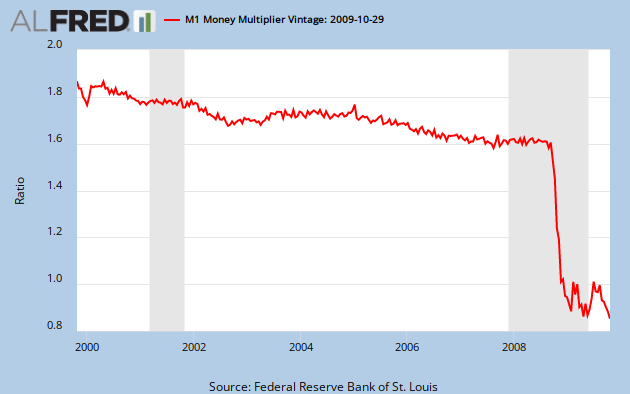

The central bank is entitled to supply aggregate reserves. The FED did so by expanding its balance sheet to record levels. However, it is the bank's role to supply end money (currency in circulation). It is their behavior which drives the deposit expansion multiplier. Designating the incremental money in circulation for each dollar added to the monetary base, the money multiplier is correlated to the banks' willingness to lend.

When the crisis peaked and confidence dropped, the deposit expansion multiplier plummeted.

A situation both visible in M1...:

A situation both visible in M1...:

As a result, M2 increased by $538 billion when the FED's balance sheet had expanded by $813 billion, a 40% difference. Bernanke succeeded in what he thought central bankers had did wrong during the Great Depression of 1931: printing sufficient money to maintain M2 expansion. History has taught central bankers a major lesson : when confidence plunges, base money supply is a poor indicator of money in circulation and thus of market liquidity.

The banks' reluctance to lend prevented the FED's expansionary monetary policy from kick starting the real economy. However, the excess money was channeled by institutional investors to financial markets and ignited an asset reflation-led recovery.

China offers a brighter picture of monetary policy effectiveness, local banks having lent accordingly to the PBOC's centrally planned and directive policies.

1 is the money multiplier threshold. Above 1, growth in the money supply exceeds base money growth. Under 1, the outcome is the opposite. Since 2007, M2 growth in China has outpaced GDP growth, implying a money multiplier >1.

Less leveraged and more state-driven than their western counterparts, Chinese banks succeeded in providing the necessary liquidity to both the real and financial domestic markets, hence maintaining annual real GDP growth >5%.

During the 4th quarter of 2008, the PBOC started by pausing its emission of central bank bills in the exchange market (sales that were aimed at offsetting upside tensions on the RMB created by the trade and capital account surpluses).

It is also worth noting that the financial environment was different before the financial crisis in China and the US, thus resulting in divergent monetary policy outcomes.

China had taken advantage of its above par expansion pace to streamline its banking system through massive capital injections and non-performing loans write-offs. The dramatic increase in liquidity in the inter-bank money market has thus spurred a rapid increase in bank credit and broad money supply.

Part 2: Money Never Sleeps, Inflation outlook in the US and China

(1) “Crossing the River by Feeling Each Stone” refers to the pragmatic policy of Deng Xiaoping, to move ahead with economic reforms slowly and pragmatically.

American and Chinese Monetary Policy