For people who still believe in a strong dollar, there is little doubt Dubai's announce that it could default on its debt was a positive Black Swan event.

1) It was rather unpredicted: Amid the annoucement, the Nikkei 225 lost 3.2 percent (its biggest one-day decline in almost eight months), the Korean Kospi fell 4.7 percent (a four-month low) Australia's S&P/ASX 200 lost 2.9 percent and Hong Kong's Hang Seng dropped 5.1 percent to 21,088.55

2) It involves systemic risks and could turn out to be the tipping point that brings us to descend the second slope of the crisis.

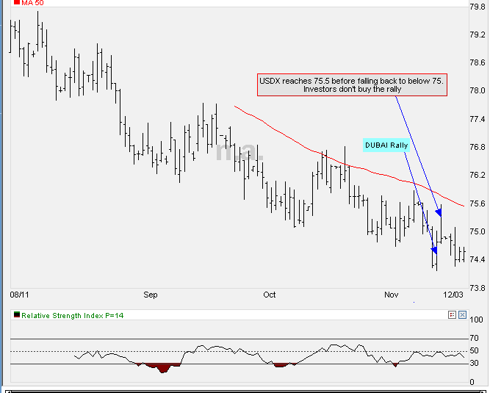

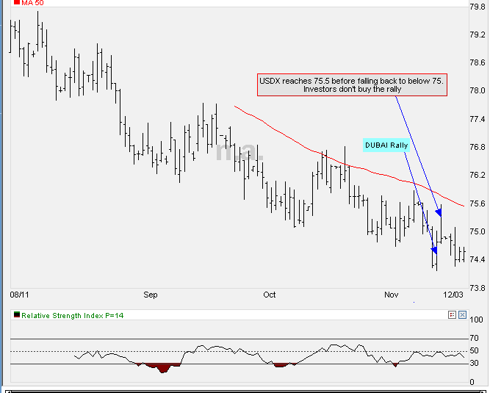

3)It triggered a (short-term) rally to the dollar, at a moment when Greenbak futures were plummetting an the dollar trade index continuing its slide.

Though, this rally was short lived, as shown below.

What we should apparently learn from this mini dollar rally is that even if Treasury debt was multiplied by 24 from US$0.5 Trillion to $12 Trillion and the US dollar Index (NYBOT US$) lost more than 16% since last March; the fly to safety argument holds firm.

The fact that the financial community continues to lend back to the government QE money by buying T-bonds even in negative rates territory is another argument supporting the "safe heaven" greenback t(h)e(rr)orists.

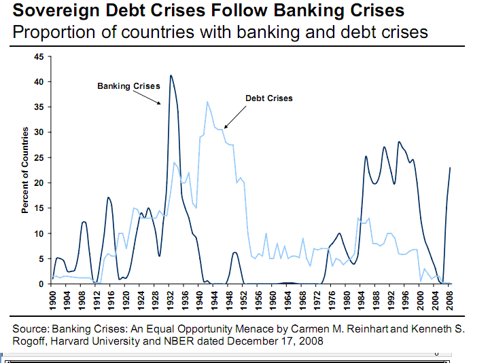

Now, let's face the other aspect of the Dubai events: the possibility of living the infamous "double dip" because of a sovereign debt crisis.

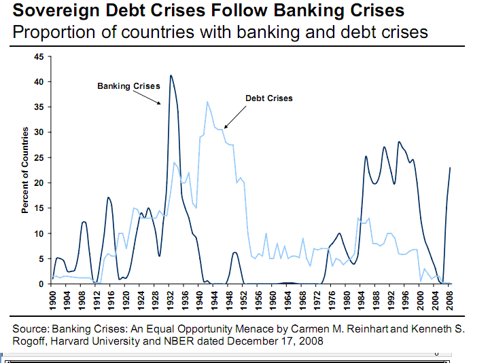

As shown by the following chart (courtesy of Morgan Stanley), the Great Depression (the only crisis comparable in direness to the one we are experiencing) was prolonged by a sovereign debt crisis.

As visible in the rise of CDS spreads, premiums are already integrating sovereign debt risks concerns.

Currently, financial institutions are comparable to boxers going entering a new round after getting beaten up in the last one, still dizzy from the uppercut received before the bell but feeling better after the medics applied soothing balm on their wounds. At this point in the fight, a slight hit from the opponent in a sweet spot would pave the way to knock out.

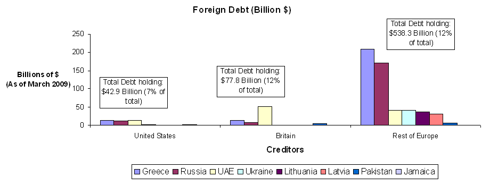

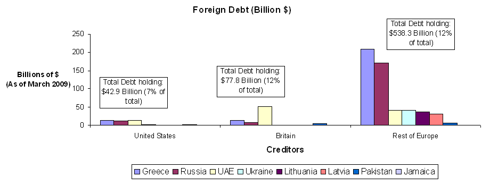

As measured by debt holding of countries with high sovereign defaulting risks, the US' exposure is less important than Europe's one, feeding bullish sentiment towards the dollar.

However, before jumping to the conclusion that the dollar will rally would Ukraine; Greece or Ireland announce they default there is at least one other aspect we should consider: governments, worlwide, seem utterly concerned by monetary policy and a "currency war" scenario should not be banned. The unwinding of the QE fed carry trade bears too heavy a political brunt to happen in an orderly fashion.

If the plumetting dollar is considered as a major issue in Japan and Europe, the impacts of an unwinding of the dollar carry trade cannot be reduced to these countries alone.

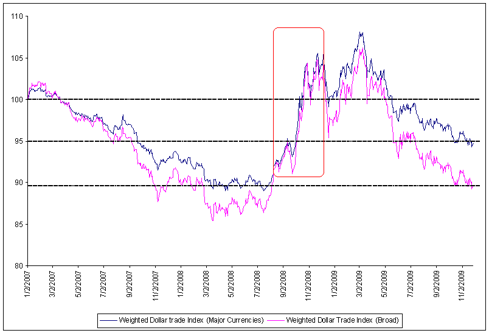

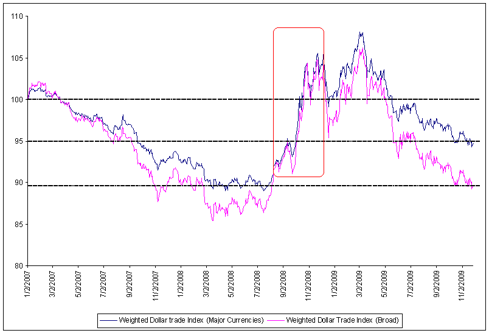

The St Louis FED establishes two trade dollar weighted indexes : USD/Major Currencies; USD/Broad

As defined by its statements:

A quick glance shows us that from the countries included only in the "broad" index, none is European.

Japan and the Euro area are both included in the Major Currency Index.

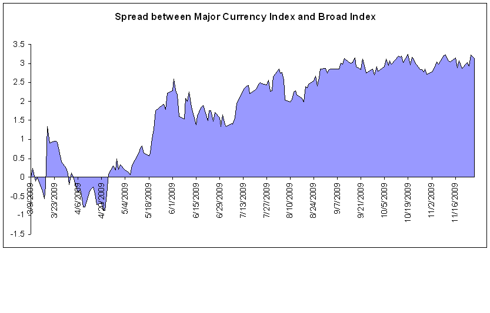

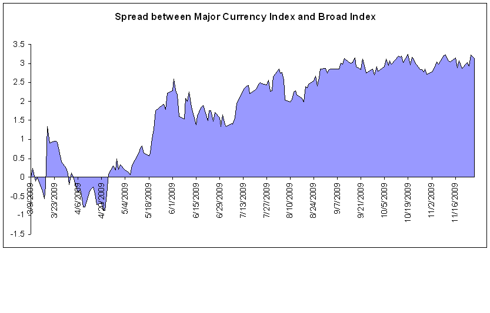

When diversification from the dollar is the trend, "emerging currencies" appreciate faster against the dollar than "Major Currencies"."Fly to safety" events erase those gains meaning they follow the same evolution to the dollar than "major Currencies". This describes the situation that occured since the beggining of the crisis:

"Fly to safety" logic relies on a risk/reward tradeoff hypothesis.

The dollar rally ignited in q4 2008 occured mostly because fears of systemic risk pushed investors to short their holdings in both "major" and "Emerging" Currencies and go long the Dollar.

Fear that we would live another Argentina-style debt default domino effect or a repeat of Q4 08 volatility is turning out to push the dollar safe-heaven status to the point it masks US fundamentals.

As of today, we have no real clue as of if a sovereign debt crisis will be contained to 2nd rank European and Middle Eastern Countries or cause a systemic shake in the global economy.

On the other hand, since the trade weighted USD index peaked on March 9th this year at 115.094 (Major Currencies Index), most of the diversification strategy has been directed towards "Emerging Currencies" (which, as seen before, do not include European Countries).

1) It was rather unpredicted: Amid the annoucement, the Nikkei 225 lost 3.2 percent (its biggest one-day decline in almost eight months), the Korean Kospi fell 4.7 percent (a four-month low) Australia's S&P/ASX 200 lost 2.9 percent and Hong Kong's Hang Seng dropped 5.1 percent to 21,088.55

2) It involves systemic risks and could turn out to be the tipping point that brings us to descend the second slope of the crisis.

3)It triggered a (short-term) rally to the dollar, at a moment when Greenbak futures were plummetting an the dollar trade index continuing its slide.

Though, this rally was short lived, as shown below.

What we should apparently learn from this mini dollar rally is that even if Treasury debt was multiplied by 24 from US$0.5 Trillion to $12 Trillion and the US dollar Index (NYBOT US$) lost more than 16% since last March; the fly to safety argument holds firm.

The fact that the financial community continues to lend back to the government QE money by buying T-bonds even in negative rates territory is another argument supporting the "safe heaven" greenback t(h)e(rr)orists.

Now, let's face the other aspect of the Dubai events: the possibility of living the infamous "double dip" because of a sovereign debt crisis.

As shown by the following chart (courtesy of Morgan Stanley), the Great Depression (the only crisis comparable in direness to the one we are experiencing) was prolonged by a sovereign debt crisis.

As visible in the rise of CDS spreads, premiums are already integrating sovereign debt risks concerns.

Currently, financial institutions are comparable to boxers going entering a new round after getting beaten up in the last one, still dizzy from the uppercut received before the bell but feeling better after the medics applied soothing balm on their wounds. At this point in the fight, a slight hit from the opponent in a sweet spot would pave the way to knock out.

As measured by debt holding of countries with high sovereign defaulting risks, the US' exposure is less important than Europe's one, feeding bullish sentiment towards the dollar.

However, before jumping to the conclusion that the dollar will rally would Ukraine; Greece or Ireland announce they default there is at least one other aspect we should consider: governments, worlwide, seem utterly concerned by monetary policy and a "currency war" scenario should not be banned. The unwinding of the QE fed carry trade bears too heavy a political brunt to happen in an orderly fashion.

If the plumetting dollar is considered as a major issue in Japan and Europe, the impacts of an unwinding of the dollar carry trade cannot be reduced to these countries alone.

The St Louis FED establishes two trade dollar weighted indexes : USD/Major Currencies; USD/Broad

As defined by its statements:

Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia.Emphasis mine. Bold shows countries present in both lists, I will call them "Emerging Currencies" from now on.

Major currencies index includes the Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden

A quick glance shows us that from the countries included only in the "broad" index, none is European.

Japan and the Euro area are both included in the Major Currency Index.

When diversification from the dollar is the trend, "emerging currencies" appreciate faster against the dollar than "Major Currencies"."Fly to safety" events erase those gains meaning they follow the same evolution to the dollar than "major Currencies". This describes the situation that occured since the beggining of the crisis:

"Fly to safety" logic relies on a risk/reward tradeoff hypothesis.

The dollar rally ignited in q4 2008 occured mostly because fears of systemic risk pushed investors to short their holdings in both "major" and "Emerging" Currencies and go long the Dollar.

Fear that we would live another Argentina-style debt default domino effect or a repeat of Q4 08 volatility is turning out to push the dollar safe-heaven status to the point it masks US fundamentals.

As of today, we have no real clue as of if a sovereign debt crisis will be contained to 2nd rank European and Middle Eastern Countries or cause a systemic shake in the global economy.

On the other hand, since the trade weighted USD index peaked on March 9th this year at 115.094 (Major Currencies Index), most of the diversification strategy has been directed towards "Emerging Currencies" (which, as seen before, do not include European Countries).

From this situation, two conclusions arise:

- With Greece, Ukraine or Iceland at the first stage the epicenter of the sovereign debt crisis seems Euro-centered. Since most of the diversification away from the dollar has been directed towards non European economies, were a dollar rally to take place in the short term it should be rather moderate. In the long-term, we have too few insights at the moment to exclude another "fly to safety"

- Omitted this far, we cannot be blind to how gold is considered as a new hedge by investors. A dollar rally scenario relies on the fact that the greenback would continue to be considered as the only "safe heaven". Since Oct 2007, fly to safety benefitted the USD but also gold, Treasuries and German bunds. Gold, above all, has tracked the major events in the Credit crisis, respectively spiking and relieving in recessions and improvements.

In the case a global sovereign debt crisis occurs, laying bare the nocuous effects of the fiat currency printing policy, there is little doubt the dollar would be the naked king.

- With Greece, Ukraine or Iceland at the first stage the epicenter of the sovereign debt crisis seems Euro-centered. Since most of the diversification away from the dollar has been directed towards non European economies, were a dollar rally to take place in the short term it should be rather moderate. In the long-term, we have too few insights at the moment to exclude another "fly to safety"

- Omitted this far, we cannot be blind to how gold is considered as a new hedge by investors. A dollar rally scenario relies on the fact that the greenback would continue to be considered as the only "safe heaven". Since Oct 2007, fly to safety benefitted the USD but also gold, Treasuries and German bunds. Gold, above all, has tracked the major events in the Credit crisis, respectively spiking and relieving in recessions and improvements.

In the case a global sovereign debt crisis occurs, laying bare the nocuous effects of the fiat currency printing policy, there is little doubt the dollar would be the naked king.